Embarking on the journey towards owning your dream home is exhilarating, and obtaining mortgage preapproval is your first serious step in this venture. Getting preapproved signifies to sellers and real estate agents that you’re a credible buyer, able to secure financing, thereby putting you in a stronger position when making offers. While this can seem daunting, the process is quite straightforward when broken down into manageable steps. Here’s your ultimate guide to acing that preapproval process, ensuring you’re set for success on your homebuying adventure.

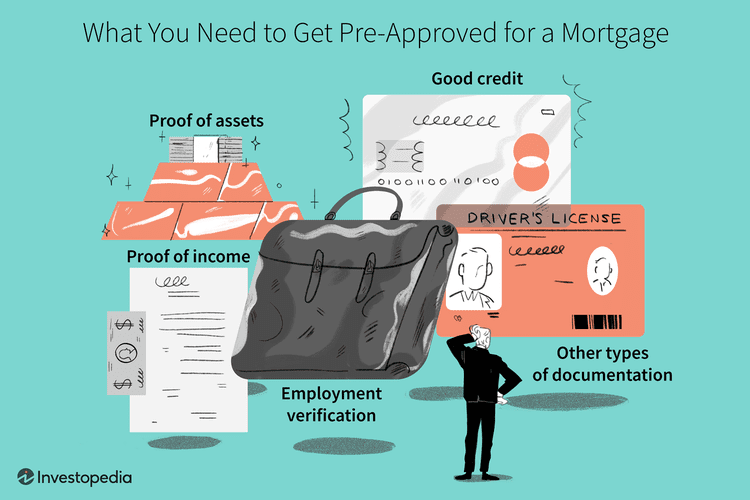

The process begins with gathering the necessary paperwork which will lay the groundwork for your preapproval application. This includes your Social Security numbers, recent W-2s or 1099s, your last few pay stubs, as well as information on your current debts and bank and investment accounts. Lenders use these documents to verify your income, assets, and debt levels, assessing your capability to take on a mortgage. Getting this documentation in order early on can save you from the scramble later and smoothen your path to preapproval.

Before approaching lenders, it’s crucial to understand where you stand credit-wise. Your credit score and history play a significant role in determining the terms of your loan and whether you qualify in the first place. Accessing your credit score early on gives you a clear picture of your financial health. Should there be any inaccuracies in your credit report, addressing these early can help boost your score, potentially securing more favorable loan terms. This proactive step can make a world of difference in the homebuying process.

- Essential documents checklist for mortgage preapproval. Source: investopedia.com

Determining your budget is next on the list. This isn’t just about how much a lender is willing to loan you, but also what you can afford to pay back. Your budget should be influenced by a realistic assessment of your debt-to-income ratio (DTI), which encompasses how much of your income goes toward paying off debts. Lenders favor a DTI of 36% or lower, so calculating this early can help you figure out a comfortable price range for your new home without stretching your finances too thin.

- Understanding your credit for mortgage preapproval. Source: investopedia.com

With your documentation ready and a clear understanding of your financial standing, it’s time to shop around for lenders. Each lender may offer different rates, fees, and terms, so it’s beneficial to compare a few before making a decision. Prepare to reach out to several lenders with your documentation in hand. This not only increases your chances of finding a better deal but also gives you insight into the different mortgage products available, helping you to choose one that best fits your needs and financial situation.

- Determining your budget for a mortgage: A visual guide. Source: nerdwallet.com

Remember, mortgage preapproval is a significant step, but it’s just one part of the journey to homeownership. It indicates your seriousness as a buyer and can give you an edge in competitive markets. By meticulously preparing your documentation, checking and improving your credit score, understanding your budget, and comparing lender offers, you’re setting yourself up for a smoother, more successful home buying process. Take these steps to heart, and you’ll navigate the path to preapproval—and eventually, homeownership—with confidence.